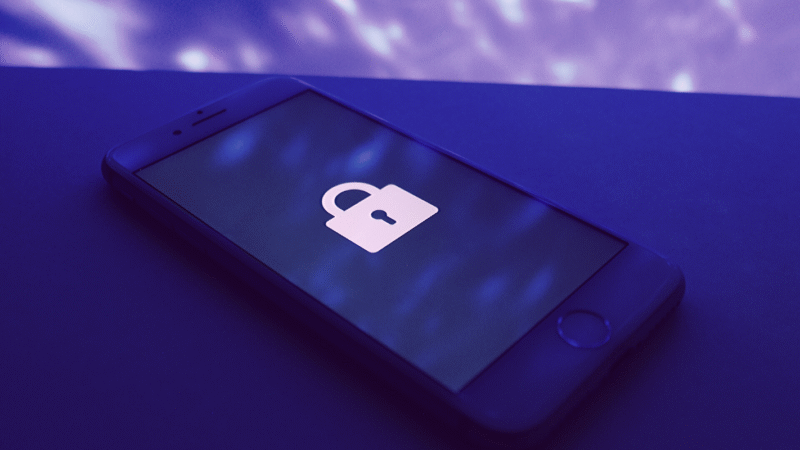

Document Verification Checks: Ultimate Protection Against Identity Theft

Fraud has a long history dating back to 300 BC. It all started when shipping trader Hegestratos pretended to wreck a ship carrying insured cargo. Then he also claimed defeat. This is the earliest recorded instance of fraud in human history. As technology develops, fraudsters get more proficient. Using forged identity documents is one of today’s most serious problems.

This scam has involved crimes like stealing money from anyone’s account, illegally traversing foreign borders, and conducting property fraud. Organizations urgently need to implement real-time security laws to prevent such crimes. Document verification checks validate identification papers issued by the government. It employs machine learning techniques, human reviewers, and automated heuristic algorithms to verify the legitimacy of a wide range of document formats.

The Importance of Documents Verification Checks

Fraudsters employ deep fake and AI technologies to impersonate others. They can traverse countries without authorization, harm anyone’s reputation, and inflict massive financial loss using phony identities. False identities are also involved in more severe crimes like drug trafficking, murder, money laundering, and terrorist financing. So, even if someone is not directly involved in the crime, they must face the consequences. As a result, a robust document validation process is required to confirm a person’s original identification.

Document Verification Checks – 3 Industries That Need It More

Every corporation should perform adequate document verification checks to secure their company. If a firm hires someone without background checks, that individual may constitute a security risk to the company. He joins the organization after being employed and receives access to the divisions handling private and financial information. He can steal or reveal sensitive corporate data. As a result, which may result in business failure. Implementing document verification tools is crucial in the following sectors:

- Financial Institutions

Financial fraud most frequently affects banking institutions. As a result, document verification in banks is critical. A fraudster employing a phony identity might compromise anyone’s account. He may impersonate another person using a forged ID card, driver’s license, or even a passport. Banks should use ML-powered document verification checks to verify the original customer’s identity.

- Transfer of Property

The shift to an online registration system has made the land record more efficient and valuable than it was previously. Unfortunately, it is becoming easier for scammers to commit their crimes. Criminals use falsified or fraudulent documents to appear as the original property owner to mortgage, sell, or acquire it. During the land transfer, live document verification methods guarantee security against identity fraud. It validates a person’s papers by employing AI and ML methods to verify an original ID card, genuine signature, or address.

- Education Industry

Document fraud has a tremendous influence on the education business. Fraudsters impersonate other students by stealing their identities. The cheater is then free to continue cheating for the remainder of his academic career by taking tests on behalf of other students. Document verification checks can match a person’s face on a document to their actual face. It compares both documents to determine if they are legitimate or counterfeit.

4 Main Benefits of Document Verification Checks

There are several benefits to doing online document verification checks. In many cases, it outperforms manual document verification. The following are the areas:

- Accuracy

The online document verification checks verify a person’s identity papers. It compares a document to thousands of others stored in a database. After that, it compares visual patterns. Several logic-based tests are also carried out.

- Time-Efficient

A machine learning-powered document-checking system can verify a document in seconds, but human verification takes a day or more. Therefore, the document verification process is more effective and quick in certifying a paper’s validity.

- Cost-Effective

A manual document-checking approach necessitates staff and associated costs and is prone to errors. Automatic document verification checks, on the other hand, automatic document verification checks need just a one-time setup fee, which can save on personnel and associated expenditures.

- Customer Experience

The AI-powered document verification checks have the potential to improve decision-making and provide the user with a quicker response. This can save clients time and increase their satisfaction with their onboarding experience.

Conclusion

Fraud has existed since the beginning of time, and its traits have evolved. Scammers deceive a person or a government by utilizing forged documents such as passports, driving licenses, and identification cards. It is possible to cross borders, purchase or sell real estate, and gain entry to anyone’s bank account, place of business, or educational institution using forged documents.

Strong document verification checks are essential to avoid document fraud. These procedures evaluate a person’s documents using machine learning algorithms. It compares a document to thousands of other papers and generates more accurate and better results than manual document verification.